Changelog

- Adjustment of the deposit amount to $1M worth of $LSK tokens and $0 worth of wETH to fully utilize the liquidity bootstrapping capabilities of Arrakis.

- Deposit of funds to the Arrakis vault are done via the specified Treasury Council.

- Update of Section “Specification” to request a $1M TVL allocation of $LSK tokens from the DAO to strengthen on-chain liquidity and create deep LSK/wETH liquidity for decreasing on-chain price impact.

- Added three new sections for clarification: Treasury Council, Member responsibility and changes, Budget.

- Update of Arrakis TVL to current numbers.

- Replace grumlin with Jash in the Treasury Council

- Replace Arrakis PALM with the new system Arrakis Pro offering modular DEX support and enhanced customizability

- Expanded the proposal to deploy liquidity on UniswapV4 due to the protocol upgrade and launch since the initial draft of this proposal.

- Updated date (day-month-year) information in the proposal and added the respective TVL

Executive summary

Arrakis Finance stands out as a pioneering market-making infrastructure protocol, allowing for sophisticated algorithmic liquidity rebalancing strategies on Uniswap. Since its inception, Arrakis has marked significant achievements, including reaching over $1.7 billion in TVL at its peak and capturing more than 25% of Uniswap V3’s total TVL.

Currently (09.04.25) Arrakis vaults hold ~$100M TVL and Arrakis actively manages the on-chain liquidity of more than 50 protocols via an automated hybrid infrastructure.

The purpose of this proposal is to introduce Arrakis Pro — the most advanced solution for managing Protocol Owned Liquidity — to the Lisk DAO for use in its Uniswap liquidity deployment.

Arrakis Pro is the latest design of the Arrakis protocol and offers modularity in terms of DEX integrations (e.g., Uniswap, Aerodrome, Pancakeswap), multi-chain support (all major EVM L2s), and the use of different Uniswap pools and hooks with support for both Uniswap V3 and V4.

Motivation

Protocol Automated Liquidity Management, is an onchain market making mechanism that taps into the organic trading volume on Uniswap V4. Arrakis Pro autonomously makes markets for protocols in a trustless way to create deep and sustainable liquidity with high capital efficiency and customizability.

The major advantages of using Arrakis Pro include:

-

Zero incentives: No Liquidity Mining (LM) incentives needed to attract community funds, liquidity bootstrapping is done solely via market making and liquidity is 100% owned by the protocol / project.

-

No self inflicted price impact: Arrakis Pro rebalances positions by setting up ranges / limit orders, no swaps involved. We algorithmically minimize price impact given the allocated capital.

-

Trustless and Self-Custodial: The customer retains the ownership of the liquidity and can withdraw at all times. Arrakis Pro smart contracts only autonomously manage the liquidity but can never remove it. Assets can be withdrawn partially or in full by the Session team at any point in time.

-

Highly customizable: Pro can be adjusted for various asset types (like stable-stable pairs) and purposes beyond token launches and liquidity bootstrapping.

-

Treasury diversification: The liquidity management strategies are deployed to consume organic orderflow to convert native tokens to the base asset (e.g. wETH) and achieve treasury diversification.

-

Simplicity of complex UniV4 Hook Architecture: Arrakis simplifies deploying liquidity on modern DEX designs and integrates viable hooks for liquidity deployment. The customer simply allocates funds to one Arrakis vault.

Rationale

Arrakis Pro stands for the latest design of Protocol Automated Liquidity Management and offers novel features along with a completely redesigned UI for liquidity deployment. We have gathered our learnings from managing protocol-owned liquidity for over three years and supporting more than 100 protocols in deploying liquidity on-chain to build Arrakis Pro as the most capital-efficient and seamless tool for token issuers on-chain. The strategic benefits of Arrakis Pro are:

Sustainable Liquidity without Incentives: Leveraging organic trading volume enables the $LSK token to sustain its liquidity without the need for continuous incentives, a fundamental step towards a more autonomous liquidity model.

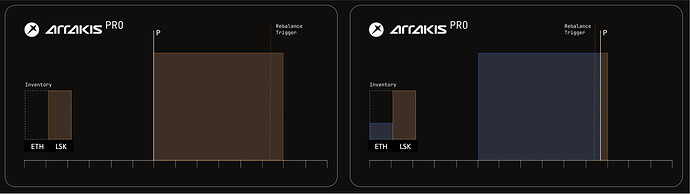

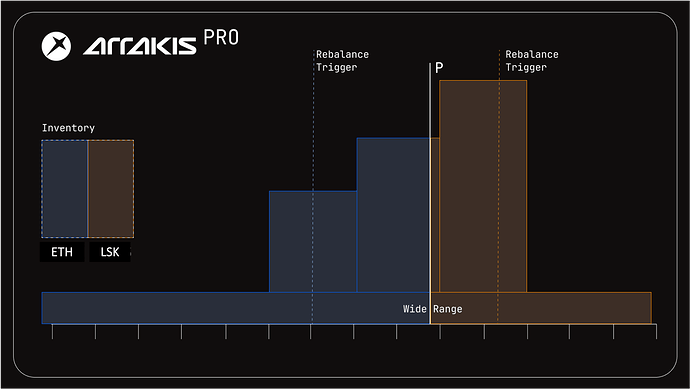

Lisk DAO deposits $LSK into a Arrakis Pro vault. By setting up limit orders, Pro will first bootstrap $wETH to pull the ratio of LSK/wETH towards 50/50 over time.

Flexibility and Efficiency: Initially, liquidity can be predominantly $LSK (e.g. 100/0 inventory ratio), which Arrakis Pro will adjust towards a 50/50 ratio, enhancing buy/sell support. But also more even inventory ratios are supported and can be deployed by the DAO.

Optimised Capital Efficiency: Through Arrakis Pro, the Lisk DAO can significantly reduce the capital required to maintain deep liquidity on Uniswap, thereby reallocating resources towards further development and growth.

Once the ratio of 50/50 is reached, the focus will be on further increasing the liquidity depth for $LSK, to minimise and equalise the price impact on both buy and sell side.

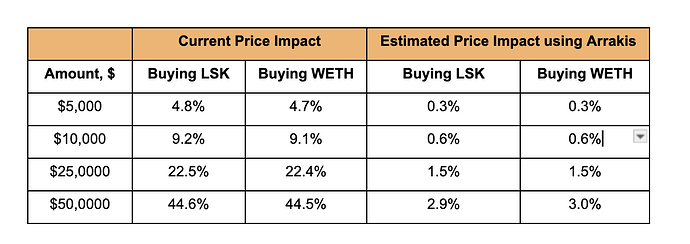

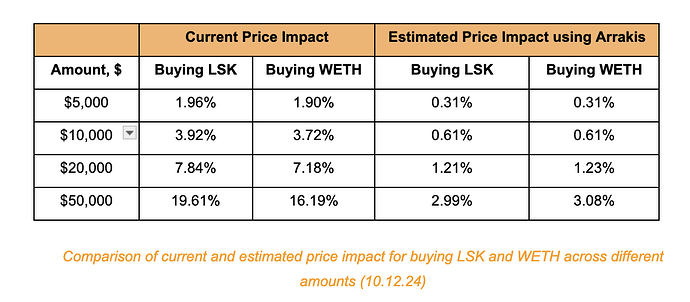

Reduced Slippage for Users: The sophisticated management of concentrated liquidity on Uniswap V4 allows for larger trades with minimal price impact, improving the overall trading experience.

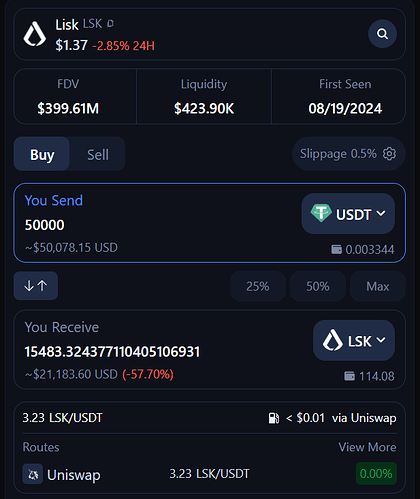

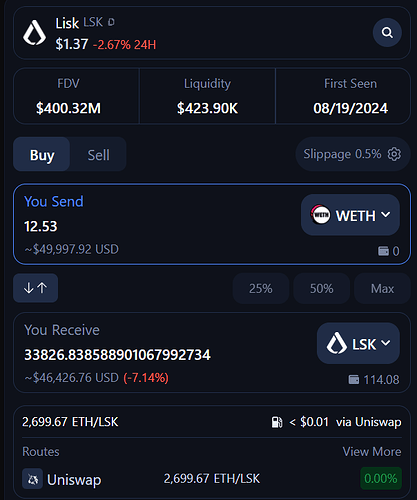

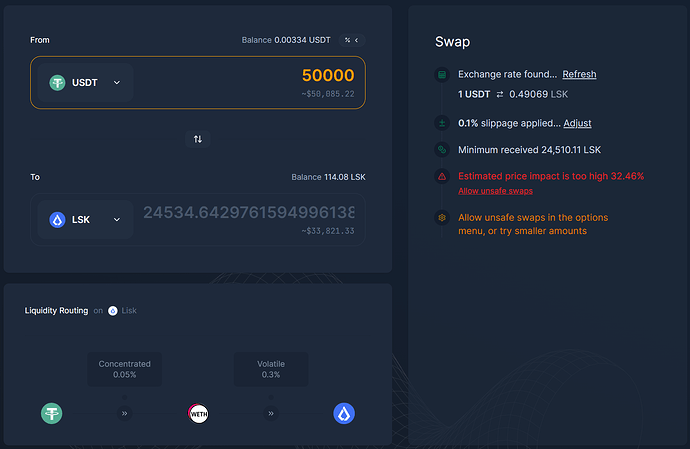

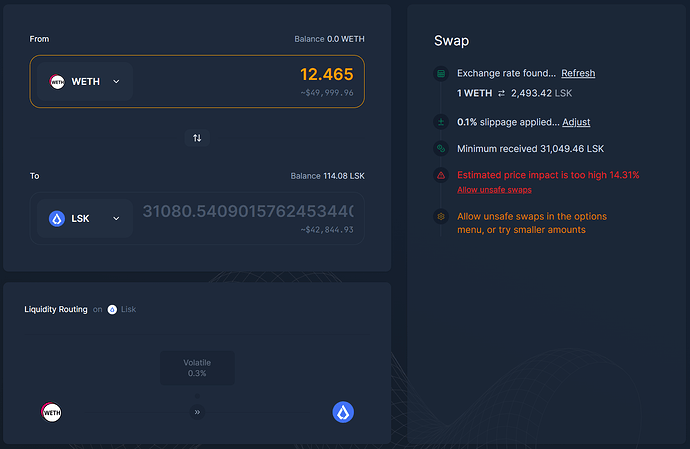

Comparison of current and estimated price impact (after successful wETH liquidity bootstrapping) for buying LSK and wETH across different amounts

Transparency and Non-custodial Approach: The Lisk DAO multisig wallet retains full custody over the deployed liquidity, with all Arrakis Pro operations verifiable on-chain.

DEX Liquidity at all times: Arrakis DEX market making strategies enable the Lisk DAO to have $LSK deep liquidity automatically managed at all times and perform algorithmic rebalances on UniswapV3 concentrated liquidity positions. This strengthens the on-chain liquidity and enables the Lisk DAO to generate return via the Uniswap trading fees earned on the deployed capital.

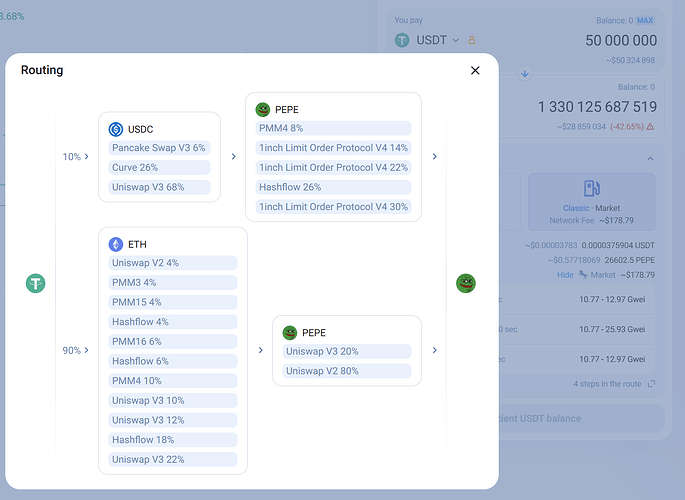

Specification

The Arrakis team uses the existing LSK/wETH pool on the 0.3% fee tier for UniswapV4. Arrakis then deploys a dedicated vault managed by the Arrakis Pro smart contract for this LSK/wETH Uniswap pool. The Lisk Treasury Council deposits $1 million worth of $LSK into the Arrakis Pro vault. Arrakis Pro will allocate the provided liquidity in a concentrated and fully active market making strategy to facilitate trading on UniswapV4. The strategy initially operates to bootstrap wETH to establish a 50/50 inventory ratio over the first months. The primary objective is to create price stability by generating deep liquidity and reaching an even inventory over time.

Treasury Council

The Treasury Council consists of the following members:

| Name | Previous roles |

|---|---|

| Jan | Chief Research Officer at Lisk |

| Andreas | Researcher at Lisk |

| Max | President at Onchain Foundation, Founder of Lisk |

| Oliver | Vice President at Onchain Foundation, Founder of Lisk |

| Luuk | Super Studio Founder |

| UZAMARU | Lisk DAO delegate, Moderator at Lisk Discord |

| przemer | Lisk DAO delegate, Moderator at Lisk Discord |

| Jash | Superchain Eco Lead |

The 8 Treasury Council members are the 8 signatories of an 5-of-8 Superchain Safe multisignature account that are the recipients of the tokens transferred through this proposal. The Treasury Council will transfer the received Lisk DAO funds from the multisignature account into the Arrakis vault on behalf of the Lisk DAO and will handle the necessary technical steps such as bridging for it. If the Lisk DAO passes a proposal to partially or fully withdraw the funds from Arrakis any time in the future, the Treasury Council will handle the withdrawal and return the funds to the Lisk DAO treasury accordingly.

Member responsibilities and changes

Each member of the Treasury Council has the following responsibilities:

- Each member of the Treasury Council must be trusted members of the community, actively involved in the Lisk ecosystem and able to complete KYC.

- Each member of the Treasury Council is obliged to execute the decisions of the Lisk DAO as described in the proposals passed by the Lisk DAO without undue delay by signing the corresponding transactions for the 5-of-8 multisignature account.

- Each member of the Treasury Council shall only sign transactions for the 5-of-8 multisignature account that are in accordance with a passed Lisk DAO proposal.

- Any member of the Treasury Council and hence 5-of-8 multisignature account can be replaced by a new member if the Lisk DAO passes a corresponding approval. Each member of the Treasury council is then obliged to sign a transaction that updates the members of the 5-of-8 multisignature account accordingly.

Budget

Members of the Treasury Council who are not part of the Onchain Foundation will receive a financial compensation for their efforts in the council. The budget always counts for one voting season and its following bridge period. The budget for each following season needs to be requested again in a proposal on the Lisk DAO.

| Item | Budget | Who receives the funds? | Who evaluates impact? | When is impact evaluated? |

|---|---|---|---|---|

| Lisk DAO Operations | 2K LSK | Lisk DAO Treasury Council | Lisk Team and Lisk DAO | At the end of the Season |

For the services provided, Arrakis charges the following fees:

Arrakis Asset-under-Management (AUM) fee: 1% per year

Arrakis performance fee: 50% of trading fees the vault generates

Reference

For more information regarding Arrakis and Arrakis Pro, feel free to have a look at our docs and join our community:

Website: https://www.arrakis.finance/

Docs: https://docs.arrakis.finance/