I want to inform the DAO that have updated the above proposal according the points mentioned in the Changelog (see at the top of the proposal) and in agreement with the proposed Lisk Treasury Council. I intend to run the voting after additional 2 weeks of discussion time. Looking forward to your feedback

Not sure what you mean here, can you explain in more detail please?

Concerning the Budget, it is stated in a separate section, which is also explaining what the budget is used for.

Not sure what you are missing. This is the section I have been referring to: Onchain Market Making for $LSK on Ethereum via Arrakis PALM

It should be clearly stated separately.

You mean how much every member of the council receives?

The budget will be equally distributed among the members. Having 4 external members in the council and a budget of two thousand LSK means each member receives 500 LSK as financial compensation for the work in the council.

We can add this to the proposal if it provides more clarity.

Sorry, today has been a tough day… It’s a nightmare, I’m looking at the book but understanding nothing… ![]()

We need to add how much funding will be allocated from the DAO treasury for Arrakis(1M$ in LSK).

Greetings, Lisk DAO Community!

We extend our sincere appreciation to Arrakis for submitting an innovative and well-considered proposal to enhance $LSK liquidity through their Protocol Automated Liquidity Management (PALM) solution. Me and my team at @discere_tech have background as credit investors, we approach this analysis through a lens focused on risk-adjusted returns, transparency, and alignment of interests. Our goal is to empower this proposal with constructive insights—rather than present a negative critique—to support the Lisk DAO in optimizing its treasury management strategy. This memorandum provides a detailed evaluation of the PALM proposal, including a cost-benefit analysis, risk assessment, and actionable recommendations.

Executive Summary

The Arrakis PALM proposal requests a $1 million allocation of $LSK tokens to an automated liquidity management vault for the $LSK/$wETH trading pair on Uniswap V3 (0.3% fee tier). The strategy promises capital efficiency, reduced slippage, and sustainable liquidity without liquidity mining incentives. However, the proposal’s 50% performance fee on trading fees and 1% AUM fee significantly reduce net returns compared to the DAO managing liquidity independently. After a thorough cost-benefit analysis, self-management yields a higher net return ($442,300 vs. $263,750 annually under baseline assumptions), though it requires operational investment. We recommend approving the PALM proposal only with revised fee terms and robust risk controls, or pursuing self-management if the DAO can build sufficient expertise.

Proposal Overview

-

PALM Proposal: Allocate $1 million in $LSK to an Arrakis PALM vault, controlled by the Lisk Treasury Council via a 5-of-8 multisig wallet. PALM will algorithmically transition the initial 100% $LSK position to a 50/50 $LSK/$wETH ratio using organic trading activity, then maintain concentrated liquidity on Uniswap V3.

-

Self-Management Alternative: The DAO directly manages liquidity on Uniswap V3, retaining full control and avoiding external fees, but incurring operational costs.

Key Benefits

- Cost-Effective Liquidity Provision

- PALM leverages organic trading volume, eliminating the need for $LSK emissions via liquidity mining, preserving token value and ownership.

- Enhanced Capital Efficiency

- Uniswap V3’s concentrated liquidity, paired with PALM’s automation, maximizes depth with less capital than traditional pools.

- Transparency and Control

- Funds remain in DAO custody via the multisig wallet, with on-chain transparency and withdrawal rights at any time.

- Improved Market Dynamics

- Reduced slippage and price impact enhance the trading experience, potentially boosting $LSK adoption and volume.

- Strategic Liquidity Bootstrapping

- Starting with $1 million in $LSK, PALM builds a balanced $LSK/$wETH pair, supporting both buy and sell activity.

Cost-Benefit Analysis

Below is a detailed comparison of the PALM proposal versus self-management, incorporating precise numerical estimates based on realistic assumptions.

Assumptions

-

Allocation: $1 million in $LSK.

-

Daily Trading Volume: $500,000 (annual volume: $182.5 million).

-

Uniswap V3 Fee Tier: 0.3% of trading volume.

-

Annual Trading Fees: $547,500 ($182.5M × 0.003).

-

DAO Team Costs (Self-Management): $100,000/year (one full-time equivalent).

-

Gas Fees (Self-Management): $5,200/year (weekly adjustments at $100 each).

PALM Proposal

-

Revenue:

-

Gross trading fees: $547,500.

-

Performance fee (50%): $273,750.

-

DAO’s share of fees: $273,750.

-

-

Costs:

- AUM fee (1%): $10,000.

-

Net Return to DAO: $263,750 ($273,750 - $10,000).

Self-Management

-

Revenue:

- Gross trading fees: $547,500.

-

Costs:

-

Team costs: $100,000.

-

Gas fees: $5,200.

-

-

Net Return to DAO: $442,300 ($547,500 - $105,200).

Comparison Summary

| Metric | Palm Proposal | Self Managment |

|---|---|---|

| Gross Trading Fees | $547,500 | $547,500 |

| Performance Fee (50%) | $273,750 | $0 |

| AUM Fee (1%) | $10,000 | $0 |

| Team Costs | $0 | $100,000 |

| Gas Fees | $0 | $5,200 |

| Net Return to DAO | $263,750 | $442,300 |

| Difference | - | +$178,550 |

Insight: Self-management outperforms PALM by $178,550 annually, driven by the absence of the 50% performance fee, though it requires operational investment.

Sensitivity Analysis

-

Low Volume ($100,000 daily):

-

Gross fees: $109,500.

-

PALM net return: $44,750.

-

Self-management net return: $4,300 (costs exceed revenue).

-

-

High Volume ($1M daily):

-

Gross fees: $1,095,000.

-

PALM net return: $537,500.

-

Self-management net return: $989,800.

-

-

PALM Efficiency (+10% fees): Gross fees rise to $602,250; PALM net return becomes $291,125, still $151,175 below self-management ($442,300).

-

Higher DAO Costs ($150,000): Self-management net return drops to $392,300, reducing the gap to $128,550.

Conclusion: Self-management remains superior unless trading volume falls below $350,000 daily or DAO costs exceed $178,550 annually.

Risks and Mitigants

The proposal and self-management alternative present risks that require careful consideration and mitigation.

PALM Proposal Risks

-

High Performance Fee

-

Risk: The 50% fee significantly reduces DAO returns, especially at moderate volumes.

-

Mitigant: Negotiate a lower fee (e.g., 20-30%) or impose a hurdle rate (e.g., 5% return before fees).

-

-

Smart Contract Risk

-

Risk: Bugs or exploits in PALM contracts could lead to losses of the $1M allocation.

-

Mitigant: Require audits within the last 6 months and secure smart contract insurance.

-

-

Oracle Vulnerabilities

-

Risk: TWAP oracle manipulation could skew pricing and performance.

-

Mitigant: Leverage Uniswap V3’s 7-day TWAP and monitor for anomalies; explore additional oracles if needed.

-

-

Platform Dependency

-

Risk: Uniswap V3 governance or fee changes could disrupt the strategy.

-

Mitigant: Diversify liquidity across DEXs (e.g., SushiSwap, Curve).

-

-

Impermanent Loss (IL)

-

Risk: Price divergence between $LSK and $wETH could erode vault value.

-

Mitigant: Use PALM’s dynamic rebalancing and model IL under ±50% price scenarios to set risk limits.

-

Self-Management Risks

-

Human Error

-

Risk: Incorrect liquidity ranges or rebalancing could reduce returns.

-

Mitigant: Train or hire skilled liquidity managers and deploy automated monitoring tools.

-

-

Resource Drain

-

Risk: Managing liquidity diverts focus from strategic priorities.

-

Mitigant: Allocate dedicated resources or outsource to a DAO expert.

-

-

Scalability Limits

-

Risk: Manual adjustments may lag in volatile markets.

-

Mitigant: Establish data-driven protocols for rapid rebalancing.

-

Financial Considerations

Opportunity Cost

-

Holding $LSK: A 50% price increase yields $500,000 in unrealized gains.

-

Lending: 2-12% APY generates $20,000-$120,000 annually.

-

PALM: Net return of $263,750 (baseline).

-

Self-Management: Net return of $442,300 (baseline).

Insight: Self-management offers the highest direct return, though PALM’s automation could free resources for other opportunities.

Fee Structure

-

PALM: $10,000 AUM fee + 50% of trading fees.

-

Break-Even Volume: $6.67M annual volume ($20,000 / 0.003) to offset AUM fee.

-

Self-Management: $105,200 in operational costs, no external fees.

Insight: PALM’s fees require substantial volume to justify, while self-management scales better with returns.

Arrakis’s Track Record

-

Peak TVL: $1.83 billion (July 2022).

-

Current TVL: $143 million (April 2024).

-

Security: Audited by WatchPug and Sherlock, with active bug bounties.

Insight: Arrakis has a strong history, but recent performance data and audits are essential to confirm reliability.

Alignment with DAO Objectives

The proposal supports the DAO’s goal of enhancing $LSK liquidity on Ethereum, critical for Layer 2 adoption. However, high fees and risks must be managed to avoid undermining financial stability.

Recommendation

We recommend pursuing self-management unless PALM offers revised terms or demonstrates superior performance in a pilot test. If opting for PALM, the following steps are critical:

- Secure Updated Audits and Data

- Require third-party audits (within 6 months) and detailed performance metrics from Arrakis.

- Refine Fee Terms

- Negotiate a performance fee of 20-30% or a 5% hurdle rate to align incentives.

- Adopt Risk Management Measures

- Diversify across DEXs and secure smart contract insurance.

- Run a Pilot Test

- Allocate $250,000 to PALM and $250,000 to self-management for 3 months to compare real-world results.

- Build Self-Management Capacity

- Assess DAO resources; if costs exceed $178,550 annually, reconsider PALM with revised terms.

Dear DAO Community,

We appreciate the detailed evaluation and your focus on optimizing treasury management. However, we believe the fee concerns in the analysis above by @East_Africa_Dev are overstated due to unrealistic volume assumptions.

Currently, on-chain trading volume for $LSK averages $5,000–$6,000 per day, far below the $500,000 baseline scenario stated in the analysis. At these levels, self-management would operate at a loss, given gas costs and resource allocation. Arrakis PALM, on the other hand, ensures automated, efficient liquidity provisioning with no operational burden on the DAO.

Even under the more optimistic $100,000 daily volume scenario considered in the analysis, self-management still results in negative net returns, while Arrakis PALM provides a positive return of ~$44,000 per year. The break-even point for self-management (assuming it matches PALM’s performance) is ~$174,000 in daily volume, which is ~35x higher than current trading activity - a highly overextended assumption.

To put this into perspective, we have modeled an optimistic scenario in which on-chain trading volume increases by 600% following the deployment of the $1M $LSK. Even in this case, PALM still significantly outperforms self-management.

| PALM Proposal | Self Management | |

|---|---|---|

| Volume Daily | $30,000 | $30,000 |

| Volume Annualy | $10,950,000 | $10,950,000 |

| Gross Trading Fees | $32,850.00 | $32,850 |

| Arrakis Performance Fee | $16,425 | $0 |

| AUM Fee (1%) | $10,000 | |

| Team Cost | $0 | $100,000 |

| Gas fees | $0 | $5,200.00 |

| Net Return to DAO | $6,425 | $ (72,350) |

| Difference | $ (78,775) |

Conclusion:

Working with Arrakis PALM is superior compared to Self-Management unless daily on-chain volume increases by 3500%—a highly unrealistic scenario based on current market conditions.

Risk Considerations

Arrakis PALM Risks:

- Smart Contract Risks: Arrakis PALM contracts have been extensively audited. Reports can be accessed here.

- Platform Dependency: Arrakis offers multi-DEX integrations, but Uniswap V3 (upgradable to Uniswap V4) remains the most liquid trading venue on Ethereum.

- Impermanent Loss (IL): Arrakis uses dynamic rebalancing to mitigate IL risk and designs custom IL mitigation strategies for next-generation DEX architectures.

Self-Management Risks

- Human Error: Requires DAO members to manually manage liquidity ranges and rebalance positions, which may reduce returns due to lack of automation.

- Resource Drain: Managing liquidity diverts strategic focus from the DAO’s core mission.

- Scalability Limits: Manual adjustments may lag in volatile markets, leading to inefficiencies and missed opportunities.

- Hidden Costs: Developing a custom algorithmic liquidity management system would significantly exceed the stated team cost assumptions.

Recommendation

We propose that the DAO adopts Arrakis PALM for a 3-month trial period to evaluate its effectiveness under real-world conditions. Since Arrakis is fully self-custodial, the treasury council can withdraw funds at any time if performance does not meet expectations.

Looking forward to further discussion and feedback from the community.

Note that as proposal action we need to define a specific LSK amount that is then transferred to the Treasury Council if the proposal passes. For this, we can therefore not use a USD amount. When creating the proposal for a vote on Tally with the Lisk Delegate, we therefore propose to use 1.5 million LSK which is slightly less than $1 million at current prices.

The proposal is now published and ready to be voted on on Tally! ![]()

The following reflects the views of L2BEAT’s governance team, composed of @kaereste, @Sinkas, and @Manugotsuka, and it’s based on their combined research, fact-checking, and ideation.

We’re voting FOR the proposal.

After reviewing the proposal and discussion around it, we see no material concerns that would make us vote against it. Arrakis Pro’s strategy should help deepen on-chain liquidity without relying on continuous incentives, and it should gradually move toward a balanced 50/50 inventory, allowing the DAO to retain custody of its assets and generate trading-fee revenue.

This is a sensible next step for the Lisk DAO: it puts idle LSK to productive use, improves price stability for traders, and does so through a transparent, non-custodial setup that allows the DAO to pause or detain at any time via on-chain voting. We look forward to seeing the program’s performance and future proposals that build on this liquidity-management framework.

For transparency, a short update on the execution of the proposal:

- The Lisk DAO Treasury Council uses the following Safe accounts for handling the funds from this proposal:

- It took now a bit of time to withdraw the 1.5m LSK from Lisk to Ethereum (7 day waiting period + 4 transactions that needed signing from at least 5 members) and then deposit the funds into the Arrakis vault. The last step was completed with this transaction this morning.

We will provide further updates once there is some meaningful data on the deployed funds and vault performance.

Could you share any historical performance data from other projects using Arrakis Pro or PALM?

Arrakis has been deployed in major Ethereum dexes in the past. I dont have docs to share but i know they did have an integration with uniswap some time back

Historical Performance of Arrakis Pro & PALM

- Kwenta (KWENTA/WETH Vault)

Kwenta initiated their PALM vault with a 5% WETH and 95% KWENTA composition. Over time, this shifted to approximately 67% WETH, achieved through market-making activities. Notably, the vault’s performance closely tracked, and at times outperformed, a simple hold strategy, indicating effective liquidity management. Across Protocol+2mirror.xyz+2Across Protocol+2

- Gelato (GEL/WETH Vault)

Starting with only 8% ETH, the GEL/WETH PALM vault managed to accumulate between 42% to 55% ETH over time. Remarkably, with just 25% of the total value locked (TVL) in the market, this vault facilitated about 66% of the total trading volume, showcasing high capital efficiency. mirror.xyz+1Flux Finance Governance Forum+1

- Perpetual Protocol (PERP/WETH Vault)

The PERP/WETH PALM vault demonstrated impressive performance by outperforming a simple hold strategy by approximately 1%. Additionally, with only 2.91% of the total TVL, it facilitated 36% of the trading volume, highlighting its effectiveness in liquidity provision. mirror.xyz

- Parallel DAO (MIMO/WETH Vault)

Parallel DAO transitioned its liquidity management to Arrakis PALM, aiming for a sustainable and efficient approach. By starting with a predominantly MIMO composition, the vault progressively balanced towards a 50/50 ratio with WETH. This strategy reduced slippage and improved capital efficiency without relying on external incentives. Across Protocol+4mirror.xyz+4Flux Finance Governance Forum+4

- Across Protocol (ACX/WETH Vault)

Across Protocol deployed PALM for its ACX/WETH pair, beginning with a 90/10 ACX to WETH ratio. Over time, PALM adjusted this towards a more balanced ratio, enhancing liquidity depth and reducing price impact for large trades. The vault’s performance remained competitive compared to other liquidity pools.

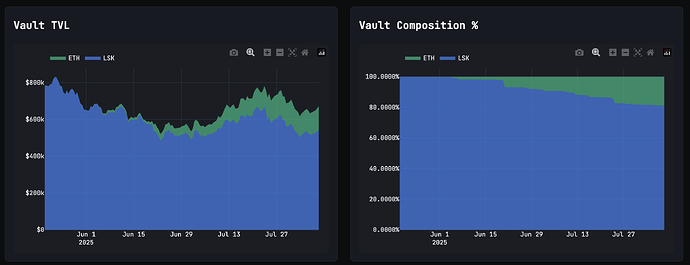

After close to 3 months collaboration between the Lisk DAO and Arrakis, I’d like to share some insights into the performance of the Arrakis vault:

Using Arrakis’ Liquidity Bootstrapping Strategy, the vault has rebalanced to ~20% base asset composition over the last weeks and continues doing so until 50:50.

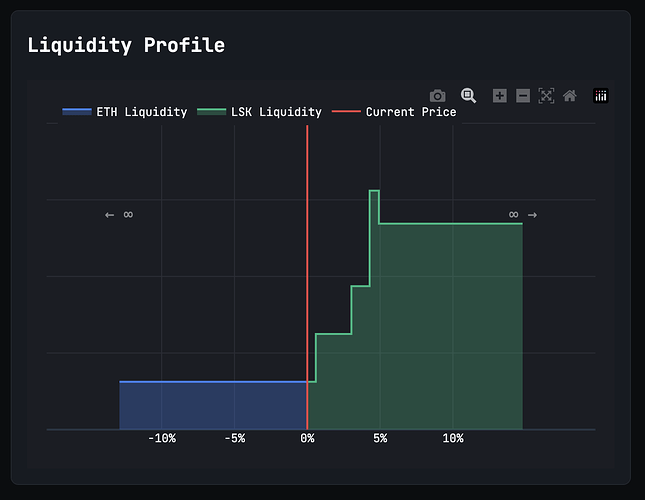

The current deployed liquidity profile resembles a order-book like liquidity profile and is targeted at providing deep liquidity for LSK/ETH while further bootstrapping the base asset.

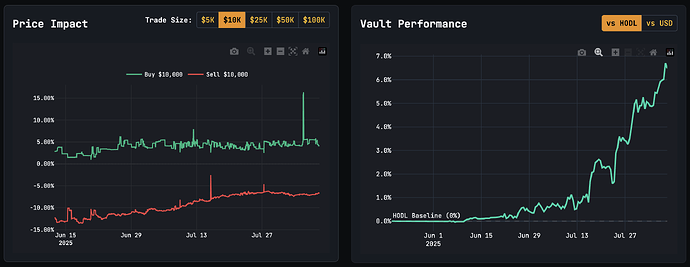

If we look at the improvement on the price impact, the price execution for a $10k has significantly improved to drop by 50% on the sell side and stabilizes around 4% on the buy side.

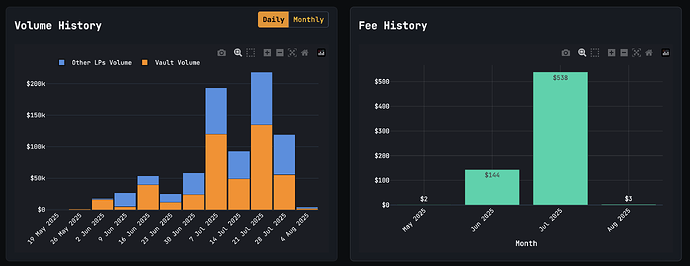

Since the introduction of the vault, the overall trade volumes on Ethereum for LSK/ETH have significantly increased which was the initial proposal of the vault.

Arrakis continues the mandate to run active liquidity management strategies for the Lisk DAO and will provide further updates regarding the vault in the future.

For further References please contact us here