EXECUTIVE SUMMARY

This proposal addresses an important upcoming issue concerning the Lisk community: whether to keep or burn the 100M DAO tokens. The Lisk team completely overhauled the tokenomics during the migration, resulting in holders receiving half the proportion they had before. The upcoming vote on these DAO tokens could increase dilution to around 62%, from the current 49%. This proposal introduces a method to unlock tokens based on the token price achieving certain milestones, ensuring incentives for token holders and new investors while driving the development of the product.

MOTIVATION

The Lisk community should approve this funding proposal because it provides a balanced approach to managing the 100M DAO tokens. By linking token unlocking to price milestones, it ensures that the token value is maintained and increased, motivating both the community and the development team. This approach helps prevent unnecessary dilution and aligns with the community’s long-term interests.

RATIONALE

This proposal aligns with the Lisk DAO mission and guiding values by promoting responsible token management, encouraging community participation, and driving product development. By setting clear price milestones for unlocking tokens, it ensures transparency and accountability, fostering trust within the community.

KEY TERMS (OPTIONAL)

- Dilution: The reduction in the ownership percentage of existing token holders due to the issuance of additional tokens.

- DAO (Decentralized Autonomous Organization): An organization represented by rules encoded as a computer program that is transparent and controlled by organization members.

SPECIFICATION

Technical Details

The proposal outlines a method to unlock the 100M DAO tokens based on the token price reaching specific milestones and maintaining those prices for a month. To ensure fairness and prevent manipulation, we will use a 1-month TWAP (Time-Weighted Average Price) to determine the token price. This approach ensures that token unlocking is tied to the sustained performance and value of the token, benefiting all stakeholders.

Action Plan

Initial Setup: Define and implement the unlocking mechanism on the blockchain.

Price and time to unlock 10M DAO tokens (both conditions must be met):

$7.5 - 01 Jan 2027

$10 - 01 Jul 2027

$12.5 - 01 Jan 2028

$15 - 01 Jul 2028

$17.5 - 01 Jan 2029

$20 - 01 Jul 2029

$22.5 - 01 Jan 2030

$25 - 01 Jul 2030

$27.5 - 01 Jan 2031

$30 - 01 Jul 2031

First Monitoring Price Report: 01 Jul 2025

WHAT DOES IT MEAN FOR LISK?

For the Lisk community, this proposal means a controlled and responsible approach to managing the 100M DAO tokens, ensuring they are only unlocked when the token’s value justifies it. This will help maintain and potentially increase the value of LSK, provide clear incentives for both existing and new investors, and drive continuous development of the Lisk ecosystem. Ultimately, it aligns the community’s interests with the project’s long-term success. If the proposal is accepted, a second vote by the team will be unnecessary because we will keep the tokens, but with price and date milestones.

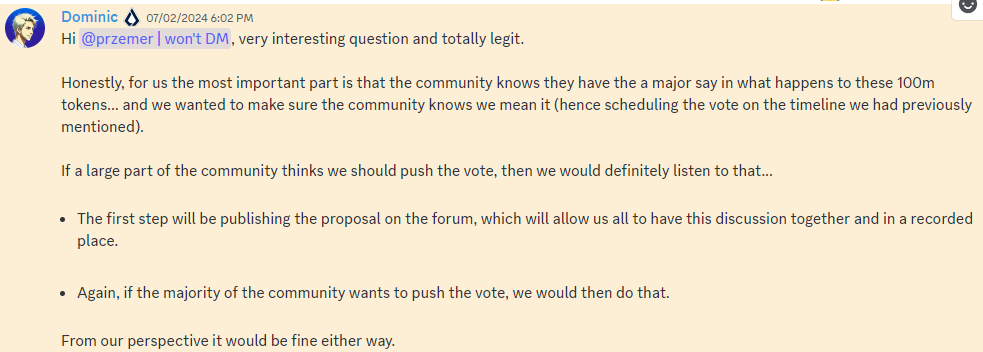

The planned voting will start on 03 September at 12:00 PM UTC+0 and will last for 1 week until 10 September.

EXAMPLES

Example 1: If the token price is currently $6, the current date is July 10, 2030, and the price increases to $22.5 and holds there for a month, then 80 million tokens will be unlocked immediately.

Example 2: If the token price is currently $30, and the current date is October 10, 2026, tokens will be unlocked over time.