Counterargument Proposal: Lisk Should Invest Excess Tokens into an Ecosystem Fund

The proposal to burn the 100 million DAO tokens aims to address concerns about token dilution and restore confidence among Lisk holders who experienced a reduction in their token proportion during the migration. However, I would like to present a counterargument in favor of investing these excess tokens into an ecosystem fund instead. Here are several reasons why this approach could be more beneficial for the Lisk community and the long-term success of Lisk:

- Stimulating Ecosystem Growth

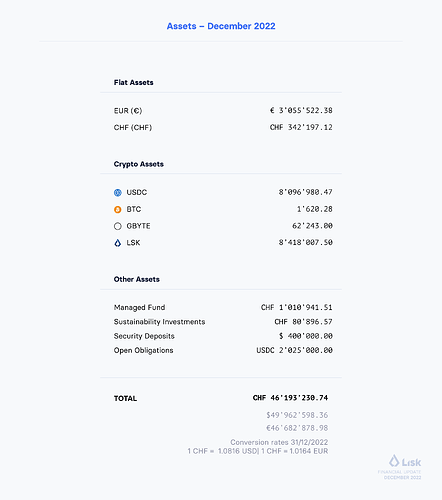

Investing excess tokens into an ecosystem fund can provide much-needed capital to support ecosystems working with Lisk in its niche markets, developers building longterm, startups, and projects building on the Lisk platform. This can stimulate innovation, attract new users, and create a vibrant, dynamic ecosystem. By supporting projects that enhance the platform’s utility, Lisk can drive adoption and usage, ultimately increasing the demand for LSK tokens.

- Long-term Value Creation

While burning tokens might provide a short-term boost in token value by reducing supply, investing in the ecosystem can lead to sustainable, long-term growth. A thriving ecosystem will generate ongoing value for the Lisk network, its users, and token holders. This approach focuses on creating a foundation for continuous development and expansion, which is crucial for the platform’s future success.

- Enhancing Network Effects

A well-funded ecosystem can attract a diverse range of projects and participants, enhancing the network effects of the Lisk platform. As more developers and users engage with the ecosystem, the platform’s overall value and utility increase. This can lead to greater token adoption, higher transaction volumes, and a more robust and resilient network.

- Attracting and Retaining Talent

An ecosystem fund can be used to provide grants, incentives, and support to talented developers and teams. This can attract top-tier talent to the Lisk ecosystem and retain those who are already contributing. By fostering a supportive environment for innovation and development, Lisk can ensure that it remains competitive and continues to evolve with the blockchain space.

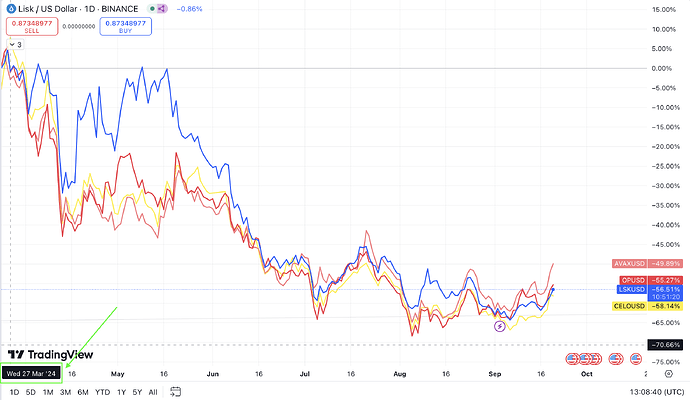

- Mitigating Short-term Market Reactions

Burning a large number of tokens can create volatility and speculative behavior in the market. While it may lead to an immediate price increase, it could also result in sudden sell-offs and market instability. Investing in the ecosystem, on the other hand, provides a more measured and strategic approach to value creation, reducing the risk of short-term market disruptions.

- Strengthening Community Engagement

By involving the community in deciding how the ecosystem fund should be allocated, Lisk can strengthen its relationship with its users and stakeholders. This participatory approach fosters a sense of ownership and collaboration, ensuring that the community’s needs and priorities are reflected in the platform’s development.

Conclusion

While the concern about token dilution is valid, the long-term benefits of investing excess tokens into an ecosystem fund far outweigh the short-term advantages of burning them. By prioritizing ecosystem growth, value creation, and community engagement, Lisk can build a more sustainable and prosperous future for the platform and its stakeholders.

Therefore, I urge the stakeholders and community to consider the broader and longer-term impact of this decision and vote in favor of investing the excess tokens into an ecosystem fund. This approach will not only address dilution concerns but also pave the way for a more innovative, robust, and valuable Lisk ecosystem.