Aya team is here:

@AyaHQ_Michael

Community report

I’m surprised he hasn’t joined the conversation since.

Same here man.

I’ve been a holder since way before L2 migration. Got my assets locked up for 2yrs. So I have good reason to make sure I do what I can to see this project thrive.

Shout out to everyone working to make sure Lisk grows ![]()

![]()

I respect and appreciate this community a lot but dear jujuboy, as an individual I respond to issues not emotions. You are one of the Lisk ambassador for Africa and I am sure you are well aware about all of the good works AyaHQ team is putting in for Lisk ecosystem. If you have any specific questions kindly ask but in the meantime, the team is busy shipping.

We are active here and bullish on the growth of Lisk. If you have any questions just ask.

Simply explain us in few words or few points how aya will contribute to growth of lisk? We want to know your long term vision.

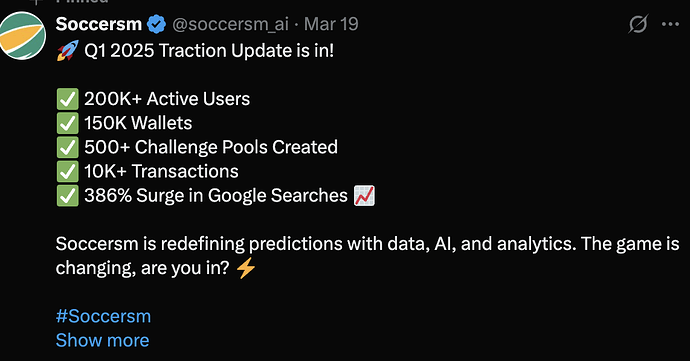

Thank you, @Filmmaniak, for your questions. AyaHQ started working with Lisk less than 12 months ago; immediately, the chain pivoted to an L2. Our goal was to bring real-world apps and applications to Lisk. For the chain to become competitive, it must find a way to attract global talents to build on its chain for the long haul. This is where AyaHQ comes in. We run a builders program, road shows for customer acquisition, and opening up new channels for Lisk in Africa.

There is no fluff, no Web3 jargon. We conduct roadshows across Africa for Lisk and turn those into distribution channels for both Lisk and the apps building on Lisk from our incubation program. Thanks to Lisk and its global community, in less than 7 months, Lisk has been well positioned as the biggest builders chain in Africa, with real products being launched and new pipelines of builders being created at every cohort.

Some of the successful projects from our ecosystems building solely on Lisk are mentioned below:

We hope you check out these projects and give them your support. AyaHQ is already contributing to Lisk’s growth and increasing the Lisk community’s GDP. I am aware there were previous community issues before partnering with Lisk, and we aim to ensure that through our hard work, we can increase the chain’s TVL and, as a result, hopefully, positively impact the token price.

Our long-term vision is to be the app onboarding layer for the Lisk ecosystem and marketing engines where founders-led stories are being told. We are also currently working with the team at Lisk to explore how products with token play coming out of the builder’s program can also reward the community with their token airdrops to get more community involvement in these projects in the early days. Watch this space

A comprehensive report with data points for cohort 1 of the builders program is here: Aya x Lisk Builders program community report: Thank you note to Lisk community + Lisk team

Feel free to dive in and will be more than happy to answer any further questions. @fgtv I will also recommend maybe we organise a twitter space for the communities to ask AyaHQ and other partners anything. I will be on standby incase the community likes the idea of an AMA.

Our gratitude to the community and Lisk team for walking this journey with us. In this present market condition, go out and touch the grass and spend more time with your loved ones, while you are doing that we are busy at work increasing the TVL of Lisk ![]()

Hello Michael,

I suppose we can always disagree to agree — and that’s the beauty of a healthy forum.

It’s great to see more engagement here, driven by genuine concern for the growth of this project. I’m glad I was able to bring y’all back into the conversation – that has always been my goal.

Your contributions to Lisk are truly appreciated. That said, for us to stay aligned and move forward effectively, we need to feel comfortable asking — and answering — sincere questions, even when they’re emotional or uncomfortable.

Keep up the good work.

— Your friendly neighbourhood vigilante ![]()

![]()

Now this is what I love to see.

It’s not just about contributing value — it’s equally important to showcase that value, so the broader community can see the impact being made.

I’d love to see more ecosystem partners come in to share insights into their work and the value it brings to the Lisk ecosystem.

Great job, @AyaHQ_Michael

Keep it up! ![]()

Oh, how bold. Have you even looked at the chart for 2024? The growth was driven solely by migration hype — and once it became clear that “the king had no clothes,” everything crashed, dropping nearly 6x over the course of 2024. The decline has continued into 2025.

Any funds granted to projects now will likely just be dumped on exchanges. There’s already no real demand for the token, and now with grants being issued, it’s even more likely they’ll be sold off — because projects need financial stability. I would do the same if I were them.

But I will vote FOR anyway.

He is not wrong, @grumlin.

Lisk has indeed seen significant growth in both popularity and adoption across high-growth markets like Africa, Asia, and LATAM.

That said, growth metrics often depend on who you ask — and when. Sentiment definitely took a hit post-migration, but that was a calculated risk by the Lisk team to reinvent the project as an L2.

Today, Lisk stands as one of the strongest Layer 2s in the space. A recent report by Hashed Emergent named Lisk the developer blockchain of choice in Africa. More and more experienced builders are now migrating their products to Lisk — and that’s real, tangible progress.

However, this momentum hasn’t yet reflected in price action. A lot of work is needed to translate this builder activity into renewed investor confidence – this should be our new focus.

Since grants are paid out in $LSK, we can’t blame builders for selling — they need liquidity to build.

What we can do is explore ways to slow the rate of disbursement:

- Milestone-based grants – Already implemented by the DAO.

- Vested token releases for ecosystem partners

Most importantly, we must give serious attention to the upcoming 100M $LSK BURN vote.

This is arguably the most critical decision we’ve faced since the migration. We need everyone to show up — share your views and vote. This is about keeping $LSK alive.

As I always say:

Our ability to sustain builder momentum in high-growth markets is directly tied to the price of $LSK.

It doesn’t matter how much $LSK we have in treasury — what matters is its dollar value.

Less is more. ![]()

I don’t disagree — but that wasn’t quite my point. You know why those specific markets were chosen? Because right now, no one else really cares about them — they’re relatively small, and Lisk wouldn’t stand a chance in more competitive regions. It would lose before even entering the market.

Lisk is just a copy-paste — it brings nothing new to the table. It’s purely betting on emerging markets and grant programs, funded using my money (yes, I’ll keep saying it — as of now, they’ve taken 60% of my tokens) through the DAO.

At least for now — that’s the reality.

I see the strategy, and YES, it comes with both pros and cons.

All our bags have taken a hit [Staked all my LSK for 2yrs immediately after migration]. But I reckon most successful projects have found themselves here at some point in their history. So my mindset right now is “How Do We Make This Right!”.

Focusing on high-growth markets is a smart, long-term play. It’s about building where impact is greatest. We’d be wrong to ignore the real opportunity in front of us because these regions will eventually catch up, and when they do, that first-mover advantage will be massive.

Like all Layer 2s, the endgame is market capture — and in that regard, Lisk is making solid progress. We now have a strong base of experienced builders and a wave of high-value products launching on mainnet — something we didn’t see before the migration.

The next logical step is restoring investor confidence. That’s the missing piece. Doubling down on OTC investors. Once they come in, retail will follow.

This is why I keep emphasizing the importance of the 100M $LSK BURN vote. It’s the first logical step toward fixing $LSK token economics and retain investors. Once that’s in motion and we secure more OTC interest, the flywheel kicks in (we’re already well-positioned with products and users in the pipeline).

The following reflects the views of L2BEAT’s governance team, composed of @kaereste, @Sinkas, and @Manugotsuka, and it’s based on their combined research, fact-checking, and ideation.

We decided to vote FOR.

Aya, AngelHack’s Lisk Spark, and Key Difference’s Pioneer Program already have solid traction and a clear record of finding promising founders in high-growth regions. Allocating the 400k LSK “Builder Programs” budget to up-and-running teams feels like the most efficient way to keep that momentum.

Having said that, our only concern is that, as things stand, it’s hard for users to verify how the funds will flow and what success will look like. Simple, periodic updates (like how many applicants each cohort attracts, how much LSK is disbursed, and which projects reach key milestones) would go a long way toward answering those questions and, eventually, toward widening the program to other regions such as Europe and America. With that added layer of transparency, we’re confident this allocation can have a good outcome.

Why allocating Lisk tokens instead of lisk team ETH reserve? Is all this must be done on cost of poor lisk holders?

Good question.

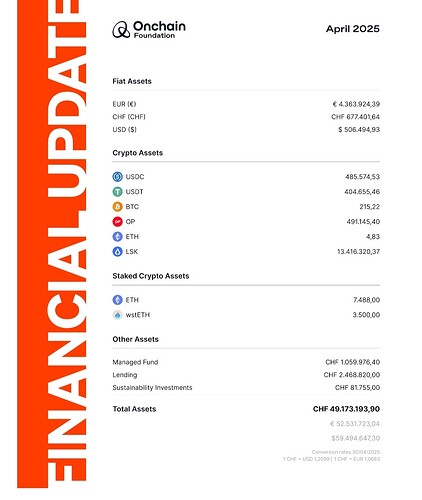

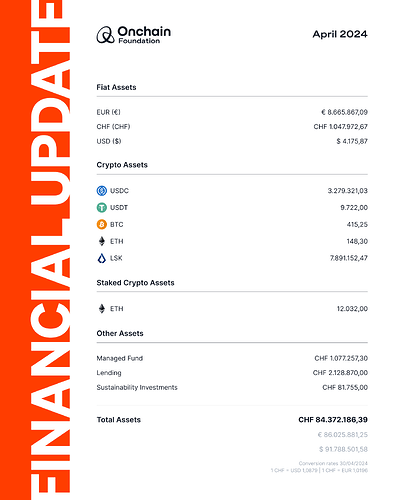

I don’t have answers but I believe the Lisk financial report for Q2 2025 would have captured this. can anyone share a link if they have access to it. The last report I have is from 2024. Not sure how things have changed since then. I can’t seem to find the more recent version of that report

So this is the report for anyone looking.

I see there’s still some ETH and BTC on reserve.

Thanks @przemer for sharing

As we can see it was bad move from BTC to ETH, in any case for now